Whatever may be your current age and financial position, you never know what’s in store for tomorrow. If you aren’t sure about tomorrow, can you be sure that what you’ve saved for retirement will see you through till your last day?

Both life expectancy and medical costs are on the rise and you don’t know if your retired phase is going to last one or three decades. For any financial planning to work effectively, knowing the time horizon is crucial but, in this case, there is no certainty of the time frame. Hence, it’s best to build a surplus into your retirement corpus. But how does one build a surplus when meeting financial goals in the first place is a challenge? You can build a cushion for your retired life by investing your savings in something that has the potential to beat inflation in the long-term and create wealth, like Mutual Funds.

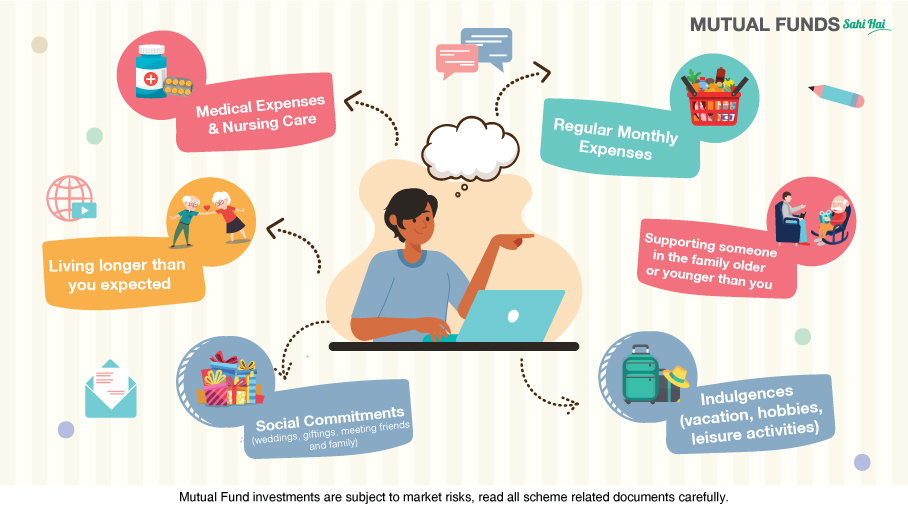

A surplus retirement fund saves you from unexpected jerks be it in the form of medical emergency or any untoward event. Also, you can afford to splurge a bit like gifting your children or grandchildren occasionally to express your love, travelling to meet family and friends more frequently, pampering yourself with indulgences. It’s never enough to save for retirement if you want to romance with it!